Roth Ira In 2025. Use this free roth ira calculator to estimate your roth ira balance at retirement and calculate how much you are eligible to contribute to a roth ira account in 2025. The roth ira income limits will increase in 2025.

You’re allowed to invest $7,000 (or $8,000 if you’re 50 or older) in 2025. The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you’re age.

Interest Rate On Roth Ira 2025 Lily Shelbi, Here are the 2025 roth ira income limits based on your modified adjusted gross income and tax filing status: This limit is now indexed for inflation and the irs updates the.

Tax Deductible Ira Limits 2025 Brooke Cassandre, In addition to the general contribution limit that applies to both roth and traditional iras, your roth ira. The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

2025 Roth Ira Limits Trude Hortense, Whether you can contribute the full amount to a roth ira depends on your. Single, head of household and married filing separately (didn’t live with a spouse in 2025)

Roth IRA Contribution Limit 2025 2025 Roth IRA Contribution Limits in, To max out your roth ira contribution in 2025, your income must be: This limit is now indexed for inflation and the irs updates the.

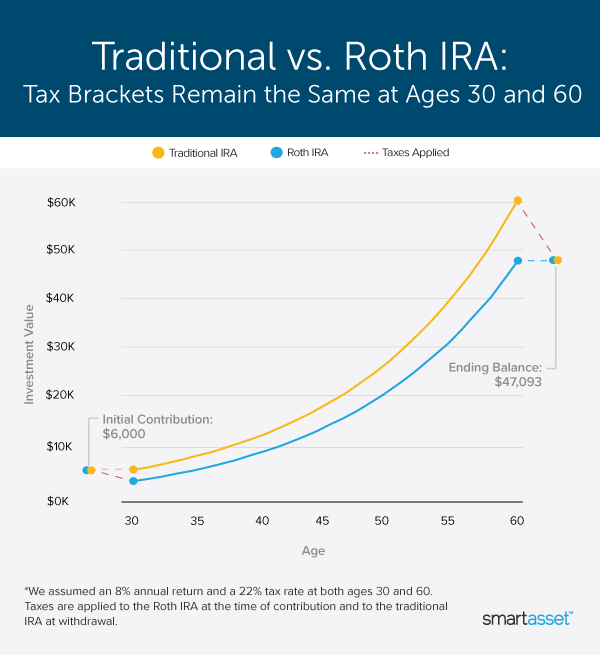

These Charts Show How Traditional IRAs and Roth IRAs Stack Up Against, Whether you can contribute the full amount to a roth ira depends on your. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.

Roth IRA Contribution and Limits 2025/2025 TIME Stamped, If you're age 50 and older, you. Here are the 2025 roth ira income limits based on your modified adjusted gross income and tax filing status:

What is a Roth IRA? Here’s what you need to know for 2025 Personal, In 2025, the roth ira contribution limit is. Use this free roth ira calculator to estimate your roth ira balance at retirement and calculate how much you are eligible to contribute to a roth ira account in 2025.

Roth IRA vs 401(k) A Side by Side Comparison, Less than $230,000 if you are married filing jointly. Contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth.

Everything You Need To Know About Roth IRAs, Use this free roth ira calculator to estimate your roth ira balance at retirement and calculate how much you are eligible to contribute to a roth ira account in 2025. This limit is now indexed for inflation and the irs updates the.

2025 Contribution Limits Announced by the IRS, The roth ira contribution limit for 2025 is $7,000, or $8,000 if you’re 50 or older. Nerdwallet's best roth ira accounts of may 2025.

The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you’re age.

Cathay Pacific Route Map 2025. Rolling daily updates (w/c dec. Cathay pacific to resume flights […]